Do you know?

What is a credit/cibil score?

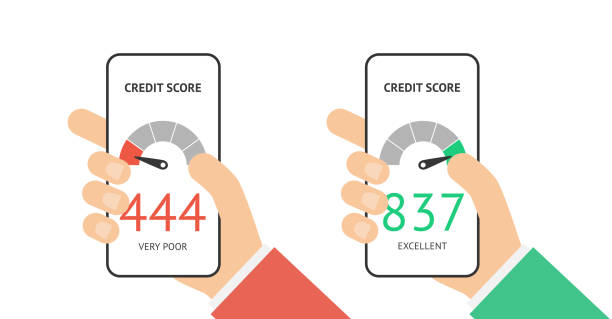

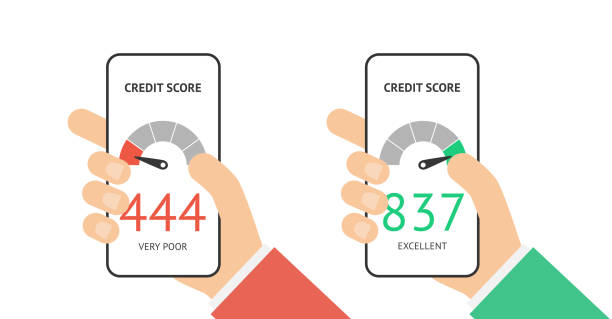

A credit score is a value between 300 to 900. This score is derived using the credit history found in your credit report(CIR) by credit bureau companies in India.

Higher the score, more are the chances to qualify you to get loans or credit cards from banks and NBFCs.

Always keep your credit score between 750 - 900

What are Credit Bureau Companies?

Credit Information Companies(Credit Bureau) are specialized financial institutions

They have its own unique formula which it uses to calculate a person’s credit score. Thus even the same individual’s credit score varies from one credit bureau to another.

At present there are 2 major Credit Information Companies in India.

1. TransUnion - CIBIL

2. Equifax

What is a credit report?

Credit Information Report

A credit report(CIR) is a detailed breakdown of an individual's credit history prepared by a credit bureau.

Major information that you will get on your CIR report provided by credit bureau companies are:

1. Credit Score

2. Employment Imformation

3. Account Information

It will have the necessary details of your credit types which include the loan amount, credit facilities, ownership details, date of last payment, account numbers, current balance, date opened, month-by-month record of all the payments made up to a period of three years, as well as the name of lenders.

Important terms in your credit report:

AMOUNT OVERDUE - Indicates the total amount that has not been paid to the lender in a timely fashion

CASH LIMIT - Applies to credit cards specifically. It is the amount of cash you are permitted to withdraw from your credit card.

CREDIT LIMIT - It reflects the total amount of credit you have access to with regard to your credit card.

SANCTIONED AMOUNT - Sanctioned amount is that amount which has been approved by our lender for a particular user. It is not the user's credit limit. After lender sanctions a particular amount we provide a credit limit which can be less than or equal to the sanctioned amount. Normally we provide a lesser credit limit. Users can get the full sanctioned amount in a period of time based on their repayment behaviour.

DPD(DAYS PAST DUE) - It indicates how many days a payment on that account is late that month.

Frequently Asked Questions

1. What is Sanctioned amount?

Answer: Sanctioned amount is that amount which has been approved by our lender. This can be lesser than or equal to your credit limit. The sanctioned amount can be approved as credit limit in a period of time.

2. Is high sanction limit a good thing? Why?

Answer: Yes, ofcourse it's a good thing. It proves that you are credit-worthy and will repay on time. A high sanction limit insures that you will be getting a high credit limit after proving your worth with good payment behaviour.

3. Is it okay to set higher sanction limit to CIBIL but be given lower credit limit?

Answer: It's okay to set higher sanction limit which will prove that you are credit-worthy. A high sanction limit doesn't prove that you have taken up a loan. It proves that you can avail a loan of upto that amount. Your credit limit will gradually increase with good payment behaviour. It's a way of risk evaulaton for the internal team and a trust gaining process after a point of which you will get a credit limit equal to your sanction amount.

4. Is this not fraud?

Answer: Absolutely not as it is a way of banking sectors to evaulate risk for a customer. For the initial months your repayment behaviour is tracked and monitored. If your repayment behaviour reaches a good benchmark then your sanction limit as well as your credit limit will increase.

5. Is a low sanction limit good for you?

Answer: A low sanction limit doesn't mean the end of the world. After proving your credit worthiness with timely payments your sanction limit will increase gradually. You may also get a credit limit equal to your sanction limit in future with good payment behaviour.

6. Does a sanction limit showing up in your CIBIL Score means that you have taken up a loan?

Answer: No it doesn't mean you have a outstanding loan. It means that you have been approved for a loan/credit card by a financial institution.

Get your credit report on https://www.equifax.co.in/ or https://www.cibil.com/freecibilscore

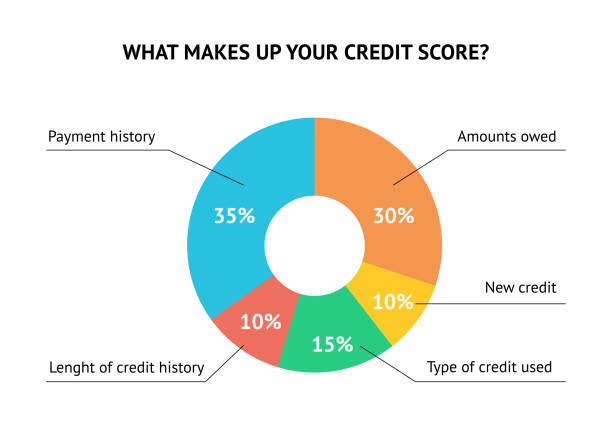

What makes up your credit score and how to improve?

How to improve your bad credit score?

Boost your credit score with Redcarpet Reset Card.